Analysis Report on the Market Research and Prospect of China’s Chain Catering Industry during 2008-2010

| 报告类型 | 纸介版 | PDF Email版 | PDF 光盘版 | 两种版本价格 |

| 价格 | 13800元 | 14800元 | | 15000元 |

| 优惠价 | | | | |

| English | | | | |

报告目录

查看简介

Chapter 1 General Description on Chain Catering Industry

Section 1 Definition and Classification of Chain Catering Industry

I. Definition of Chain Catering Industry

II. Classification of Chain Catering Industry

Section 2 Characteristics and Segmentation of Chain Catering Industry

I. Basic Characteristics of Chain Catering Industry

II. Segmentation of Chain Catering Industry

Chapter 2 Status and Characteristics of the Development of Global Catering Industry in 2007

Section 1 Analysis on the Development of Global Chain Catering Industry

Section 2 Status and Basic Characteristics of the Development of Global Catering Industry in 2007

I. Size of the Industry

II. Structure of the Industry

III. Trend of the Industry

Section 3 Development of the Chain Catering Industry in Main Countries

I. USA

II. France

III. Germany

IV. Japan

Chapter 3 Analysis on Management Invironment of China’s Chain Catering Industry in

Section 1 Economic Environment

I. The stimulatory effect of economic growth on Chain Catering industry

IIThe impact of economic growth on industry structure

Ⅲ The analysis of China’s macro-economy environment in 2007

Section 2 Policy Environment

I The updated policies of China’s chain catering industry

II"Resource-saving society" and chain catering industry

Section 3 Culture and Social Environment

I The influence of Chinese Cultural Background on chain catering industry

II. The development of Chinese chain catering culture

III. Effect of Chinese catering culture on circumference

IV. Western-style chain catering and development in China thereof

Chapter 4 Analysis on the Development of 2007 China’s Chain Catering Industry

Section 1 Analysis on the Development of China’s Chain Catering Industry

Section 2 Analysis of China’s Chain Catering Industry Status in

I Analysis of China’s chain catering industry scale

IIAnalysis of China’s Chain Catering Industry Structure

Section 2 Characteristics of Chinese Chain Catering Industry in 2007

I Analysis of Chinese Chain Catering Industry’s Life Cycle

II. Analysis of Concentration of Chinese Chain Catering Industry

III. Analysis of Capital and Labor Intensive Feature of Chinese Chain Catering Industry

IV Operating risks of Chinese Chain Catering Industry

V The status of Chinese catering industry’s industry barrier

Section 3 The position of China’s Chain Catering Industry in Consumer Consumption

Section 4 Analysis of Problems in China’s Chain Catering Industry

Chapter 5 Analysis of Economic Operation of China’s Chain Catering Industry in 2007

Section 1 Basic Analysis of the Above-Limits Chain Enterprises

I. General information

II. Bistros

III. Franchisees

Section 2 Analysis of Different Types of Catering Chain Enterprises

I. State Owned Enterprises

II. Collective Enterprises

III. Share Cooperated Enterprises

IV. Limited Liability Company

V. Joint Stock Company

VI. Private Enterprises

VII. Enterprises Invested by Hong Kong, Taiwan and Maca

IX . Foreign Owned Enterprises

Section 3 Basic Information Analysis of Different types of Enterprises of Catering Chain Industry

I. Dinner Service

II. Fast Food Service

III. Beverage and Cold Drink Service

IV. Other Catering Services

Chapter 6 Research over Consumption Morphology of China’s Chain Catering Industry in 2007

Section 1 Analysis of Consumption Groups of China’s Chain Catering Industry in 2007

I.Analysis of changes of the consumption levels of China’s town dwellers

II.Comparison to expenditures on eating-out of China’s town dwellers in different years

III. Research of the consumer group of tourism and chain catering industry

Section 2 Analysis of Consumption Structure of China’s Chain Catering Industry in 2007

I. Analysis of the consumption structure of town dwellers in chain catering industry

II. Consumption characteristics in different chain catering industries

III. Consumption structure of tourism chain catering

IV . Chain catering consumption expenditure structure in different regions

Section 3 Analysis of Consumption Demands of China’s Chain Catering Industry in 2007

I. Changing trend on chain catering consumption quality

II. Analysis of payout for outer dining of different income families

III. Analysis of the characteristics of private chain catering consumption

IV. Requirement characteristics of mass consumption

Section Four Analysis of Consumption Habits of China’s Chain Catering Industry in 2007

I. Changes of China’s chain catering market

II. Analysis of target market of chain catering industry

III. Analysis of the factors impact on chain catering consuming

IV. Consumption Psychology of Chain Catering Industry Consumers

V. Investigation of Consumption Time of Chain Catering Industry

Chapter 7 Market Operation Analysis of China’s Chain Catering Industry in

Section 1 Market Scale Analysis of Chain Catering Industry in 2007

I. The market scale and increasing trend of 2007

II. The proportion change information of Chain Catering Industry in resident consuming in 2007

Section 2 Information Analysis of Chain Catering Store in 2007

I. Analysis of General Operation Information of Chain Catering Market in 2007

II. The development characteristics of chain catering market in China

III. The important factors of the development of chain catering market in 2007

IV. China laid stress on brand strategy in the Chain Catering Industry in

Chapter 8 Distribution Analysis of China’s Chain Catering Enterprises in

Section 1 Analysis of Above-Limits Chain Catering Industry Groups (According to Industry Distribution)

I. Dinner

II. Fast Food

III. Tea Shop

IV. Coffee Shop

V. Other Chain Catering industry

Section 2 Analysis of Above-Limits Chain Catering Industry Groups (Distributed as the register types)

I. Domestic Invested Enterprises

II. Limited Liability Company

III. Limited Company

IV. Private Enterprises

V. Other Types of Enterprises

VI. Enterprises Invested by Hong Kong, Taiwan and Macao

VII. Foreign Invested Enterprises

Section 3 Analysis of Above-Limits Chain Catering Industry Groups (According to Industry Distribution)

I. Dinner Service

II. Fast Food Service

III. Beverage and Cold Drink Service

IV. Other Catering Service

Chapter 9 Analysis of Store Number Distribution of China’s Chain Catering Industry in 2007

Section 1 Analysis of Store Number Distribution of China’s Catering Industry in 2007

Section 2 The Number of Store of China’s Dinner Chain Industry in 2007

Section 3 The Number of Fast Food Store of China’s Chain Operating Industry in 2007

Section 4 The Number of Tea shops in China’s Chain Operating Industry in 2007

Section 5 The Number of Coffee Shops in China’s Chain Operating Industry in 2007

Section 6 The Number of Other Types Store of China’s Chain Operating Industry in

Chapter 10 Analysis of Sales Income of China’s Chain Catering Industry in 2007

Section 1 Business Revenue Analysis of Above-Limits Chain Catering Enterprises

I. Dinner

II. Fast Food

III. Tea Shop

IV. Coffee Shop

V. Other Chain Catering Industry

Section 2 Income Analysis of Above-Limits Chain Catering Enterprises

I. Dinner

II. Fast Food

III. Tea Shop

IV. Coffee Shop

V. Other Chain Catering Industry

Chapter 11 Competition Situation Analysis of China’s Chain Catering Industry 2007

Section 1 The Present Situation of China’s Chain Catering Industry 2007

I. Competition situation analysis of the industry

II. Analysis of industry competition action

III. Analysis of enterprises concentration in the industry

IV. Analysis of industry brand competition

Section 2 Analysis of Regional Competition Situation of China’s Chain Catering Enterprises in

Section 3 Analysis of International Competitive ability of China’s Chain Catering Industry

Section 4 Analysis of Enterprise Competition Situation of China’s Chain Catering Industry 2007

Chapter 12 The Development of Chain Catering Industry in Important Cities 2007

Section 1 Beijing

I. The development of Beijing Chain Catering Industry

II. Scale of Beijing’s chain catering market 2007

III. The development of Beijing’s chain catering enterprises 2007

IV. New characteristics and development trend of Beijing’s Chain Catering Industry 2007

Section 2 Guangzhou

I. The Development of Guangzhou Chain Catering Industry

II. The scale of Guangzhou’s chain catering market 2007

III. The development of Guangzhou’s chain catering industry 2007

IV. The development tendency of Guangzhou chain catering industry 2007

Section 3 Shanghai

I. The development of Shanghai Chain Catering Industry

II. Scale of Shanghai’s chain catering market

Section 4 GuangdongI. The development of Guangdong’s chain catering Industry

II. Scale of Guangdong’s chain catering market

Section 5 Chongqing

I. Development of .Chongqing’s Chain Catering Industry

II. Scale of Chongqing Chain Catering Market in 2007

III. Development of Chong Chain Catering Enterprises 2007

IV. New characteristics and developing tendency of Chongqing chain catering industry in 2007

Section 6 Hubei

I. Development of Hubei chain catering industry

II. Scale of Hubei chain catering market

Chapter 13 Key Enterprise Competitive Power Analysis of China’s Chain Catering Industry 2007

Section 1 Yum! Restaurants China

I. Operation condition analysis in 2007

II. Competition advantages analysis

III. Estimation of development prospect

Section 2 Beijing McDonald’s Food Co., Ltd.

I. Analysis of the company’s operation strategy

II. Analysis of enterprise marketing strategy

III. Estimation of development prospect

Section 3 Inner Mongolia Little Sheep Catering chains Chains Ltd.

I.Analysis of operating status

II. Analysis of Development Strategy

III.Forcasting of the Development Prospect

Section 4 Inner Mongolia Xiaoweiyang Catering Chains Ltd.

I.Analysis of operating status of 2007

II.Analysis of the competitive advantage of Xiaoweiyang

III. Analysis of development strategy

Section 5 Beijing Quanjude Group

I.Analysis of operating status of 2007

II.Analysis of development strategy

III.The forecasting of the developing perpect

Chapter 14 Forecasting Development Trend of China’s Chain Catering Industry during 2008-2010

Section 1 Development Trend of China’s Chain Catering Industry during 2008-

I . The Trend in Scale Development of China’s Catering Industry.

II. The Trend in Structure Development of China’s Catering Industry.

Ⅲ. Attaching importance to talent in the development of Chain Catering Industry.

IV . The mega trend of Chain Catering Industry Running Transform.

Section 2 Market Development Trend of China’s Chain Catering Industry during 2008-2010

I . The proportion of family holiday consumption rises

II. Individuation brand and characteristic consumption has become increasingly obvious.

Ⅲ. Development trend of innovative business

IV . Rapid development of chain operation.

V. Fierce competition between brand culture and service quality.

Section 3 The New Trend of Market Subdivision of China Chain Catering Industry in 2008-2010

I . On the rise of the green chain catering industry

II. The chain management will be the main direction

Ⅲ. The content of chain catering will be increasingly rich

IV . Casual chain catering will be consumption new fashion

V .Take away becomes the new market share of chain catering industry

Section 4 Development Trend of China’s Chain Catering Industry in key consumption cities during 2008-2010

I . The prospects of Beijing Chain Catering Industry

II. Analysis on development trend of Shanghai chain catering industry.

Ⅲ. An analysis of the trend of Tianjin chain catering market

IV. The developing trend of Shenzhen chain catering industry

V . Development trend of chain catering market in Guangzhou.

Chapter 15 Analysis on Investment Prospect of China’s Chain Catering Industry

Section 1 Investment Charateristics of 2008-2010 China’s Chain Catering Industry

I. The growth and profitability of Chain Catering Industry

II. Periodicity of Chain Catering Industry

III. The denseness of source element in chain catering industry

Section 2 Analysis of Industry Barrier in Chain Catering Industry

I. Technical and Market Barrier

II. Structural barriers

III. Systematic barrier

IV. Cultural barrier

Section 3 Analysis on Investment Prospect of 2008-2010 China’s Chain Catering Industry

I. Essential factors in investing chain catering

II. Chain catering industry tends to be information-based management mode

III. Analysis of key investment projects of chain catering market

IV. China’s chain catering industry invests chain leisure catering

Section 4 2008-2010 Investment Risk Alarm on China’s Chain Catering Industry

Chapter 16 2008-2010 Suggestion from Investing Expert about China’s Chain Catering Industry

Table of Chart

Chart 1 Analysis of China’s GDP Increase during 2003-2007 Unit:.0.1 billion Yuan

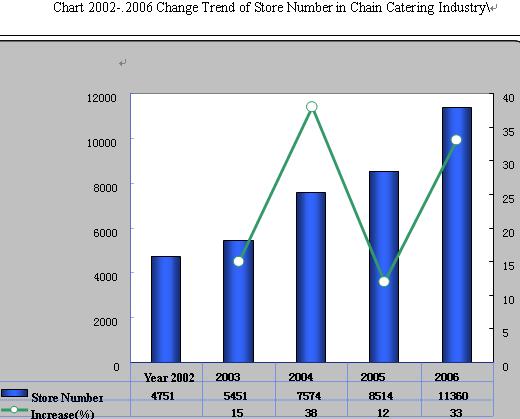

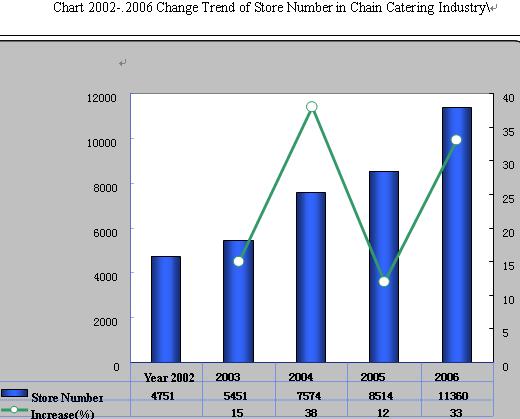

Chart 2 Change Trend of Store Number of Catering Industry during 2002-.2006

Chart 3 Change Trend of the Number of Catering Groups during 2002-.

Chart 4 Proportion of the Numer of Catering Stores above the Designated Size in China

Chart 5 Sales volume of the catering chain stores above designated size

Chart 6 Retailing Volume and Growth Rate of Catering Industry During 1994-.

Chart 7 Contrast Diagram KFC and McDonald’s Advertisement Investment Strength

Chart 8 General Information of the Above-Limits Chain Enterprises in 2006

Chart 9 Information of Above-Limits Catering Chain Bistros in 2006

Chart 10 Trend Chart of the Total Amount of Above-Limits Chain Bistros in 2002-2006

Chart 11 Trend Chart of Business Revenue of Above-Limits Chain Bistros in 2002-

Chart 12 Information of Above-Limits Chain Franchisees in

Chart 13 Trend Chart of Total Amount Above-Limits Chain Franchisees in 2002-

Chart 14 Trend Chart of Business Revenue of Above-Limits Chain Franchisees in 2002-2006 Unit: Ten Thousand Yuan

Chart 15 Basic Information of China’s State Owned Catering Chain Enterprises in 2006

Chart 16 Trend Chart of Business Revenue of State Owned Enterprises of China’s Above-Limits Catering Chain industry in 2002-2006

Chart 17 Basic Information of China’s Catering Chain Collective Enterprises in 2006

Chart 18 Trend Chart of Business Revenue of Collective Enterprises of China’s Above-Limits Catering Chain Industry in 2002-2006

Chart 19 Basic Information of China’s Catering Chain Share Cooperated Enterprises in 2006

Chart 20 Trend Chart of Business Revenue of Share Cooperated Enterprises of Above-Limits Catering Chain Industry in 2002-

Chart 21 Basic Information of China’s Limited Liability Company of Catering Chain in 2006

Chart 22 Trend Chart of Business Revenue of Limited Liability Company of Above-Limits Catering Chain Industry in 2002-2006

Chart 23 Basic Information of China’s Joint Stock Company of Catering Chain Industry

Chart 24 Trend Chart of Business Revenue of Joint Stock Company of China’s Above-Limits Catering Chain Industry in 2002-

Chart 25 Basic Information of Private Enterprise of China’s Catering Chain Industry in 2006

Chart 26 Trend Chart of Business Revenue of Private Enterprises of China’s Above-Limits Catering Chain Industry in 2002-2006

Chart 27 Basic Information of Enterprises Invested by Hong Kong, Taiwan and Macao of China’s Above-Limits Catering Chain Industry in 2002-2006

Chart 28 Trend Chart of Business Revenue of Enterprises Invested by Hong Kong, Taiwan and Macao of China’s Above-Limits Catering Chain Industry in 2002-

Chart 29 Basic Information of Foreign Owned Enterprises of China’s Catering Chain Industry in 2006

Chart 30 Trend Chart of Business Revenue of Foreign Owned Enterprise of China’s Above-Limits Catering Chain Industry in 2002-2006

Chart 31 Basic Information of China’s Dinner Service Industry in 2006

Chart 32 Basic Information of Fast Food Chain Catering Industry in 2006

Chart 33 Basic Information of Chain Beverage and Cold Drink Service Industry in 2006

Chart 34 Basic Information of Other Chain Catering Services Industry in

Chart 35 Growth trend of the expenditures on eating-out of the China’s town dwellers in different stages during the opening-up period

Chart 36 Trend Chart of Business Revenue of China’s Above-Limits Chain Catering Industry in 2002-2006 Unit: Ten Thousand Yuan

Chart 37 The Proportion of Monetary Total of China’s Social Consuming Retail in Chain Catering Industry

Chart 38 Basic Information of Above-Limits Chain Catering Industry in 2006

Chart 39 Information of Dinner Groups Distribution Number in Above-Limits Chain Catering Industry in 2006

Chart 40 Information of Business Revenue distribution of Above-Limits Chain Catering Industry in 2006

Chart 41 Information of Fast Food Groups Distribution Number of Above-Limits Chain Catering Industry in 2006

Chart 42 Information of Business Revenue Distribution of Fast Food Enterprises of China’s Above-Limits Chain Catering Industry

Chart 43 Information of Distribution Number of China’s Tea Shop Groups of Above-Limits Chain Catering Industry in 2006

Chart 44 Business Revenue Distribution Information of Tea Shop Groups of China’s Above-Limits Chain Catering Industry in 2006

Chart 45 Distribution Number Information of Coffee Shop Groups of China’s Above-Limits Chain Catering Industry in

Chart 46 Business Revenue Distribution Information of Coffee Shop Groups of China’s Above-Limits Chain Catering Industry in 2006

Chart 47 Information of Distribution Number of China’s Other Chain Catering industry Groups of Above-Limits Chain Catering Industry in 2006

Chart 48 Business Revenue Distribution Information of Other Catering Industry Groups of China’s Above-Limits Chain Catering Industry in 2006

Chart 49 Information of Distribution Number of Domestic Invested Enterprises of Above-Limits Chain Catering Industry in 2006

Chart 50 Information of Distribution Number of Limited Liability Company of Above-Limits Chain Catering Industry in 2006

Chart 51 Information of Distribution Number of Limited Company of Above-Limits Chain Catering Industry in 2006

Chart 52 Information of Distribution Number of Private Enterprises of Above-Limits Chain Catering Industry in

Chart 53 Information of Distribution Number of Other Types of Enterprises of Above-Limits Chain Catering Industry in 2006

Chart 54 Information of Distribution Number of Enterprises Invested by Hong Kong, Taiwan and Macao of Above-Limits Chain Catering Industry in 2006

Chart 55 Information of Distribution Number of Foreign Invested Enterprises of Above-Limits Chain Catering Industry in 2006

Chart 56 Information of Distribution Number of Dinner Service Enterprises of Above-Limits Chain Catering Industry in 2006

Chart 57 Information of Distribution Number of Fast Food Service Enterprises of Above-Limits Chain Catering Industry in 2006

Chart 58 Information of Distribution Number of Beverage and Cold Drink Service

Chart 59 Information of Distribution Number of Other Catering Service

Chart 60 The number of Store of China’s Above-Limits Chain Catering Enterprises in 2006

Chart 61 Trend Chart of Total Amount of Above-Limits Chain Catering Enterprises in 2002-2006

Chart 62 Number of Dinner Chain Store in 2006

Chart 63 Trend Chart of Total Amount of Dinner Chain Store in 2002-2006

Chart 64 The number of fast food chain store in 2006

Chart 65 Trend Chart of Total Amount of Fast Food Chain Store in 2002-

Chart 66 The number of chain tea shop in 2006

Chart 67 The number of coffee chain store in

Chart 68 Trend Chart of Coffee Chain Store in 2002-2006

Chart 69 The Number of Other Types Store of China’s Chain Operating Industry in 2006

Chart 70 Trend Chart of Total Amount of Other Types Store of China’s Chain Operating Industry in 2002-2006

Chart 71 Business Revenue Trend Chart of Dinner Chain catering Industry in 2002-2006

Chart 72 Business Revenue Trend Chart of Fast Food Chain Catering Industry in 2002-2006 Unit: Ten Thousand Yuan

Chart 73 Business Revenue Trend Chart of Tea Shop Chain Catering Industry in 2004-2006

Chart 74 Business Revenue Trend Chart of Coffee Shop Chain Catering Industry in 2002-2006

Chart 75 Business Revenue Trend Chart of Other Chain Catering Industry in 2002-2006

Chart 76 Income Trend Chart of Dinner Chain Catering Industry in 2004-2006

Chart 77 Income Trend Chart of Fast Food Chain Catering Industry in 2004-

Chart 78 Income Trend Chart of Tea Shop Chain Catering Industry in 2004-

Chart 79 Income Trend Chart of Coffee Shop Chain Catering Industry in 2004-

Chart 80 Income Trend Chart of Other Chain Catering Industry in 2004-2006

Chart 81 Proportion chart of business revenue of China’s chain catering industry above designated size for different regions

Chart 82 Business revenues of China’s chain catering industry above designated size for different regions in 2006 Unit: Ten Thousand Yuan

Chart 83 2005-2007 Analysis of the Increase of Beijing’s Catering Retail Sales Unit:.0.1 billion Yuan

Chart 84 Retail Sales of Guangzhou’s Catering Industry from 2000 to 2006 Unit:.0.1 billion Yuan

Chart 85 the number and share of Guangzhou’s chain catering enterprises (groups) above designated size

Chart 86 Analysis of Proportion of Shanghai’s Chain Catering Enterprises Above Designated Size up to 2006

Chart 87 Analysis of Proportion of Shanghai’s Chain Catering Enterprises Above Designated Size with Different Ownerships 2006

Chart 88 Analysis of the Increase of Store Number of Shanghai’s Chain Catering Enterprises Above Designated Size 2006

Chart 89 Analysis of the Increase of Annual Business Revenue of Shanghai’s Chain Catering Enterprises Above Different Designated Size 2006

Chart 90 Analysis of the Proportion of Guangdong’s Chain Catering Enterprises with Above Different Ownership Enterprises in 2006

Chart 91 Analysis of the Proportion of Guangdong’s Chain Catering Enterprises with Above Different Designated Size 2006

Chart 92 Analysis of Store Number of Guangdong’s Chain Catering Enterprises above Designated Size 2006

Chart 93 Analysis of Store Number Proportion of Guangdong’s Chain Catering Enterprises above Designated Size 2006

Chart 94 Analysis of Business Annual Revenue Increase of Guangdong’s Chain Catering Enterprises above Designated Size in 2006 Unit: Ten Thousand Yuan

Chart 95 The Store Number of Chongqing’s Chain Catering Enterprises above Designated Size in 2006

Chart 96 Annual Business Revenue of Chongqing’s Chain Catering Enterprises above Designated Size Unit: Ten Thousand Yuan

Chart 97 Changing tendency of business revenue of Chongqing Chain Catering Enterprises above Designated Size 2003-2006 Unit: Ten Thousand Yuan

Chart 98 Changing Tendency of Store Number of Chongqing Chain Enterprises above Designated Size Unit: Ten Thousand Yuan

Chart 99 Analysis of proportion of Hubei chain catering enterprises above designated size

Chart 100 Analysis of Store number of Hubei chain catering enterprises above designated size 2006

Chart 101 Increase analysis of annual business revenue of Hubei catering enterprises above designated size in 2006 Unit: Ten Thousand Yuan

报告简介

Chain-store operation has been largely applied in China’s catering industry since ten years ago. Meanwhile, there come up many national food & beverage chain enterprises such as Tanyutou, Xiaotianer, Dezhuang, RBT, Donglaishun, Dicos, Yonghe King, Little Sheep, Xiaotudou, etc.

China’s large scale chain catering operation especially the regular chain business develops powerfully. Fast-food, meals on wheel and take-out, hotpot chain store and group mess develop quickly. The chain-store operation has become the main operation style. Among them, the operation scale of fast-food overruns the scale of dinner in eastern provinces. China’s chain catering industry mainly distribute to eastern provinces and big cities. But the speed of penetrating to western provinces and middle-sized cities is accelerating.

In 2006, the number of china’s above-limits chain catering group (enterprise) amounts to 349, increasing 16.33%; the number of store is 11360, increasing 33.43%; the business area is 5,882,000 square meters, increasing 50.51%; the number of seat served is 2,748,000, increasing 37.13%; the business revenue is 55.19 billions Yuan, increasing 41.91%.

But at the same time of fast extending of chain catering industry, there is gradually exposing inner problems such as lacking brand management, increasing of franchisee’s disputes, went short of human resources, weak training power, behindhand delivery technology and system, and difficulty in product’s standardizing, etc. And the external food security crisis problems in hotpot ingredients and Tony red, force the restaurant chain enterprises in the predicament constantly searching for solutions to mature. Sense from a strategic level, management, brands, culture and business model will constitute a solid foundation for catering enterprises, and only they can help catering enterprises to success as four legs of chain operation.

China’s food era of big profits has become history. And mass and rational consumption become the mainstream. Therefore, only merger and conglomeration, and taking the road of chain operations and scale economy are the best options of survival and development.

Chain management is not only enterprises to improve the efficiency and lower the cost of operation, more importantly, to help enterprises to breakthrough management bottlenecks in the development. Chain operation has the advantages in cost, price and superior service.

This report describes thoroughly the operation environment of China’s Chain Catering industry, primarily studies and predicts the long-term and short-term trend of the development and demand change of downstream industry. Aim at the opportunity and threat which the current industry faces, put forward the investment and stratagem advices of the development of chain catering industry. This report helps the chain catering industry exactly grasp the development tendency; correctly formulate the enterprise’s competition stratagem and investment stratagem. Our main sources are in National Bureau of Statistics of China, State Information Center, China Customs, Electric Machinery Association and other authoritative specialty institute and the practical research and study of our center. This report conforms the data resources and expert resources of lots of authoritative institutes, abstracts the precise and appropriate and valuable advices from lots of data, combines the environment which the industry locates, researches and analyzes many points of view from theory to practice and from macroscopic view to microcosmic view and the conclusion and viewpoint strives to reach the unification of prophecy, practicability and feasibility. It is an elaborate report by the expert group for taking one year of time through the market research and data collection. It is one of the important decision-making basis for the relative investment company and government department exactly grasping the industry development trend and discerning the competition pattern in the industry, evading the operation and investment risk, working out the correct competition and investment risk, working out the correct competition and investment stratagem decision, has the important reference value.