行业分类

IT、液晶(English)

IT产业 液晶产业 整机

IT服务 配件外设 软件

电信增值(English)

电信增值(English)

电信设备 运营商

终端 电信产业

增值服务

网络无线(English)

网络无线(English)

网络产业 网络服务

电子商务 网络游戏

宽带无线

饮食烟酒(English)

饮食烟酒(English)

饮食产业 饮料 餐饮

烟草 酒类 乳制品

食品 食用油 调味品 家电、3C(English)

家电、3C(English)

家电产业 视听家电

空调 冰箱 洗衣机

小家电 厨卫

家电其他 电子电工(English)

电子电工(English)

集成电路 消费电子

通讯电子 汽车电子

电子元件 电工器材 交通物流(English)

交通物流(English)

汽车 摩托 物流运输

交通设备 交通其他 日化化妆(English)

日化化妆(English)

日化产业 洗涤用品

化妆养护 医药保健(English)

医药保健(English)

医药产业 中西药品

保健品 医疗器械

医药原料 生物制药 能源石化(English)

能源石化(English)

能源产业 电力电池

石油化工 煤燃气水 服装纺织(English)

服装纺织(English)

服装鞋帽 纺织原料

毛皮箱包 饰品珠宝 房产建筑(English)

房产建筑(English)

房产产业 建筑机械

办公家居 建材 其他行业(English)

其他行业(English)

传媒印刷 教育文体

旅游宾馆 冶金制造

照明玻璃 机械制造

化工树脂 商贸 农业

造纸 树脂 金融

玩具 其他 机电行业(English)

机电行业(English)

![]()

IT产业 液晶产业 整机

IT服务 配件外设 软件

电信增值(English)

电信增值(English)电信设备 运营商

终端 电信产业

增值服务

网络无线(English)

网络无线(English)网络产业 网络服务

电子商务 网络游戏

宽带无线

饮食烟酒(English)

饮食烟酒(English)饮食产业 饮料 餐饮

烟草 酒类 乳制品

食品 食用油 调味品

家电、3C(English)

家电、3C(English)家电产业 视听家电

空调 冰箱 洗衣机

小家电 厨卫

家电其他

电子电工(English)

电子电工(English)集成电路 消费电子

通讯电子 汽车电子

电子元件 电工器材

交通物流(English)

交通物流(English)汽车 摩托 物流运输

交通设备 交通其他

日化化妆(English)

日化化妆(English)日化产业 洗涤用品

化妆养护

医药保健(English)

医药保健(English)医药产业 中西药品

保健品 医疗器械

医药原料 生物制药

能源石化(English)

能源石化(English)能源产业 电力电池

石油化工 煤燃气水

服装纺织(English)

服装纺织(English)服装鞋帽 纺织原料

毛皮箱包 饰品珠宝

房产建筑(English)

房产建筑(English)房产产业 建筑机械

办公家居 建材

其他行业(English)

其他行业(English)传媒印刷 教育文体

旅游宾馆 冶金制造

照明玻璃 机械制造

化工树脂 商贸 农业

造纸 树脂 金融

玩具 其他

机电行业(English)

机电行业(English)

GUIDE OF Entrance to Chinese Telecom service market

完成日期:2005年5月

| Report Type | Price($) | rebate($) | ||

| Paper Report | 3300 |

Words | 65000 |

|

| PDF Email | 3500 |

pages | 120 |

|

| PDF CD | Charts | 0 |

||

| All price | 3700 |

Some Sections |

Content Index

First policy

1 Chinese management system of foreign capital

1.1 Phases of Chinese management system of foreign capital

1.1.1 Phase 1

1.1.2 Phase 2

1.2 primary content of Chinese management of foreign capital

1.2.1 Examine and approve to the admittance of foreign capital

1.2.2 Supervise of the investment of foreign capital

1.2.3 General service for investors and foreign capital

1.2.4 the basic method of Chinese management system of foreign capital

1.3 General department of Chinese management of foreign capital

1.4 project classify of foreign capital

1.5 Jurisprudence of investment of foreign capital

1.5.1 Constitution

1.5.2 Laws about foreign investment

1.5.3 Other laws about foreign investment

1.5.4 International convention

2 analysis of policy of Chinese foreign capital

2.1 Definition of Chinese foreign capital investment

2.2 Analysis of Chinese management system of foreign capital

2.2.1 Analysis of Chinese management system of foreign capital

2.2.2 Promise of open of Chinese telecom service market

2.2.3 Analysis of laws and rules about invest of foreign capital

2.3 resolve of the important policy and system of foreign capital

2.3.1 correlated content of <Chinese enterprise law about Joint venture>

2.3.2 Correlated content of <Chinese implement statute about Joint venture>

2.3.3 Analysis of <temporary ordain of M & A of foreign investor>

2.3.4 Implement of Chinese government promise to WTO

2.3.5 Analysis and implement of CEPA

2.3.6 Analysis of <ordain of foreign capital invest to Chinese telecom enterprise>

2.3.7 correlated rules about foreign capital of <telecom statute>

2.3.8 Analysis of <telecom service classify catalog>

3. Analysis of Chinese telecom supervision system and policy

3.1 telecom supervision system

3.2 telecom supervision policy

3.2.1 Policy of interconnect

3.2.2 Guarantee on price

3.2.3 Universal service

3.2.4 charge of telecom resource

3.2.5 Annual check

4 Forecasting of the telecom policy

4.1 trend of the open of telecom market

4.1.1 Strategy of open of telecom market of China government

4.1.2 Policy to change in the near future

4.2 Forecasting of the hotspots in telecom industry

4.2.1 the delivery of 3G license in China

4.2.2 policy of VOIP

4.2.3 IPTV & triple play

The second: process for foreign capital

5. process of entrance into Chinese telecom industry of foreign capital

5.1 process of examine and approve of set up of telecom enterprise for foreign capital

5.2 classify of application of telecom service

5.2.1 Fundamental service and value-added service multi-province

5.2.2 Value-added service inner province

5.2.3 special rules of investment of foreign capital

5.3 the government department of the procedure

5.4 qualification of set up of telecom enterprise for foreign capital

5.5 prepare of the document of application

5.6 application agent and the information

6. Rules of set up of telecom enterprise for investors of Hongkong and macao

6.1 main basis

6.2 rules about joint venter’s supply of value-added service

6.3 procedure of examine and approve

6.4 qualification of material business of Hongkong investors

6.5 procedure of acquire the treatment of the rules

6.6 other aspect

7. rules of M&A in China telecom market for foreign capital

7.1 rules of enter China by means of M&A

7.1.1 Definition of enter China by means of M&A

7.1.2 basis of M&A

7.1.3 laws of M&A

7.1.4 proportion of investment

7.2 procedure of acquire the treatment of M & A

7.3 agreement & trade price of purchase of assets

7.3.1 Agreement of purchase of assets

7.3.2 trade price of purchase of assets

7.4 time limit of payment for M & A

7.5 enroll capital of agreement of purchase and the upper limit of investment

7.5.1 enroll capital of agreement of purchase

7.5.2 The upper limit of investment

7.6 document of delivery to the department of examine and approve

7.7 agreement of capital added inner China

7.8 prepare of capital and document of foreign capital

7.8.1 amount of capital of M & A

7.8.2 Document to prepare for M & A

THE THIRD Telecom service market

8. General trend of China telecom market

8.1 General status of China telecom market

8.1.1 history of telecom industry

8.1.2 Development of scriber size of telecommunication

8.1.3 Development of industry revenue

8.1.4 Development of investment

8.1.5 Characteristic of Chinese telecom consumers

8.1.6 Characteristic of Chinese telecom commercial consumer

8.2 Segmental telecom service market

8.2.1 Fixed telephony service

8.2.2 Mobile phone service

8.2.3 PHS service

8.2.4 Broadband service

8.2.5 Mobile value-added service

8.3 Telecom industry structure

8.3.1 General structure of telecom industry

8.3.2 Industry structure of fixed telephony service

8.3.3 Industry structure Mobile phone service

8.2.3 Industry structure PHS service

8.2.4 Industry structure Broadband service

8.2.5 Industry structure Mobile value-added service

8.4 contrast of telecom service between China and other countries

8.4.1 Contrast of subscriber number

8.4.2 Contrast of service revenue

9. Investment hotspots of China telecom industry

9.1 General description of telecom investment

9.2 3G service

9.2.1 forecasting of 3G service

9.2.2 3G strategy of Chinese telecom service providers

9.3 Investment of mobile value-added service

9.3.1 MMS

9.3.2 WAP

9.3.3 CRBT

9.3.4 JAVA & BREW

9.4 Investment hotspots of broadband

9.4.1 IPTV

9.4.2 IM

9.4.3 Online Game

9.5 other telecom services

9.5.1 VOIP

9.5.2 WLAN

10 Forecasting of telecom trend

10.1 Forecasting of investment environment

10.2 Forecasting of technology development

10.3 Possibility of recombine of telecom service providers

10.4 Life circle of telecom service

The fourth SUGGESTION OF ENTRANCE OF FOREIGN CAPITAL

11. Experience and trend of entrance of foreign capital

11.1 course of entrance of foreign capital\

11.1.1 General status of China use foreign capital

11.1.2 Symbol of entrance of foreign capital

11.2 The way that foreign capital entered

11.2.1 Telecom investment method

11.2.2 proposal of license

11.3 form that foreign capital exist in China telecom industry

11.3.1 Joint venture

11.3.2 Overseas office

11.3.3 Strategic cooperation

11.3.4 Strategic investment

11.4 representative case of entrance of foreign capital

11.4.1 case of VC

11.4.2 Case of Joint venture

11.5 brief summary

11.6 Forecasting of the future of foreign capital

11.6.1 Change of method of Entrance of foreign capital

11.6.2 Forecasting of the future of foreign

12 Suggestion of entrance of foreign capital

12.1 strategy analysis of entrance of foreign capital

12.1.1 attraction of China telecom market

12.1.2 analysis of entrance obstacle

12.1.3 SWOT analysis of foreign telecom service provider

12.2 CSF of entrance of foreign capital

12.3 Suggestion of invest method

12.3.1 Indirect investment

12.3.2 VC

12.3.3 Joint venture

12.3.4 M&A

12.3.5 Absolute operation

12.4 Suggestion of entered province

12.5 Suggestion of entered business domain

12.5.1 Fundamental telecom service

12.5.2 Value-added service

12.5.3 Entrance time

12.5.4 MVNO and its possibility

Table index

Table2-1 agreement of telecom service in china of WTO

Table3-1 purview of guarantee of price

Table8-1 The structure of telecom service revenue of 2003-2004

Table8-2 compare of China telecom service revenue and GDP

Table8-3 the rate of popularization of China telecom service

Table8-4 structure of telecom industry after recombine

Table8-5 mobile subscriber number and market share in 1998-2003

Table8-6 new subscriber number in 2004

Table8-7 some index of economic of important country in the world

Table8-8 compare of phone and mobile number of China and other countries

Table8-9 telecom service revenue of China and other countries

Table9-1 process of 3G in China

Table9-2 Chinese MMS subscriber number in 2003-2005

Table9-3 Chinese WAP subscriber number in 2003-2005

Table9-4 Chinese CRBT subscriber number in 2003-2006

Table9-5 Chinese WLAN subscriber number in 2002-2006

Table11-1 increase of foreign loan in China in 1980-2000

Table11-2 important events of entrance of foreign capital

Table11-3 process of VC of IDG

Table12-1 SWOT analysis of foreign telecom service providers in China

Table12-2 rules of proportion of share control by foreign capital in China telecom market

Graph index

Graph 3-1 guarantee system of China telecom market

Graph 3-2 law system of telecom price

Graph 3-3 structure of telecom price guarantee

Graph 5-1 process of examine and approve of investment on telecom enterprise for foreign capital

Graph 6-1 process of examine and approve of investment on telecom joint venture for capital of Hongkong and Macao

Graph 7-1 process of examine and approve of M & A in telecom industry

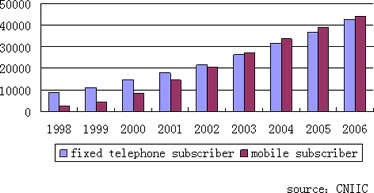

Graph 8-1 Increase of number of fixed phone, mobile phone and Internet in 1998-2006

Graph 8-2 increase of telecom service revenue in 2002-2004

Graph 8-3 structure of telecom service revenue in 2003-2004

Graph 8-4 ratio of telecom service quantity, revenue and GDP

Graph 8-5 increase of CAPEX of telecom industry in 1998-2008

Graph 8-6 CAPEX area structure in 2004

Graph 8-7 increase of subscriber number of fixed telephone(2002-2004)

Graph 8-8 increase of subscriber number of mobile telephone(2002-2004)

Graph 8-9 increase of subscriber number of PHS(2002-2004)

Graph 8-10 Subscriber number compare between PHS and fixed telephone

Graph 8-11 Increase of broadband subscriber number(2002-2004)

Graph 8-12 market structure of fundamental telecom service in China

Graph 8-13 market share of fixed telephone

Graph 8-14 Subscriber number compare of fixed telephone and mobile between China and other countries

Graph 8-14 Subscriber number compare of telecom service revenue between China and other countries

Graph 9-3 Increase of subscriber number of CRBT in China(2003-2006)

Graph 9-4 Increase of online subscriber number of IM in China(2002-2006)

Graph 9-5 Increase of revenue of online game in China(2001-2004)

Graph 10-1 life cycle of several telecom service in China in 2005-3-10

Graph 12-1 Entrance obstacle of China telecom service industry for foreign capital

First policy

1 Chinese management system of foreign capital

1.1 Phases of Chinese management system of foreign capital

1.1.1 Phase 1

1.1.2 Phase 2

1.2 primary content of Chinese management of foreign capital

1.2.1 Examine and approve to the admittance of foreign capital

1.2.2 Supervise of the investment of foreign capital

1.2.3 General service for investors and foreign capital

1.2.4 the basic method of Chinese management system of foreign capital

1.3 General department of Chinese management of foreign capital

1.4 project classify of foreign capital

1.5 Jurisprudence of investment of foreign capital

1.5.1 Constitution

1.5.2 Laws about foreign investment

1.5.3 Other laws about foreign investment

1.5.4 International convention

2 analysis of policy of Chinese foreign capital

2.1 Definition of Chinese foreign capital investment

2.2 Analysis of Chinese management system of foreign capital

2.2.1 Analysis of Chinese management system of foreign capital

2.2.2 Promise of open of Chinese telecom service market

2.2.3 Analysis of laws and rules about invest of foreign capital

2.3 resolve of the important policy and system of foreign capital

2.3.1 correlated content of <Chinese enterprise law about Joint venture>

2.3.2 Correlated content of <Chinese implement statute about Joint venture>

2.3.3 Analysis of <temporary ordain of M & A of foreign investor>

2.3.4 Implement of Chinese government promise to WTO

2.3.5 Analysis and implement of CEPA

2.3.6 Analysis of <ordain of foreign capital invest to Chinese telecom enterprise>

2.3.7 correlated rules about foreign capital of <telecom statute>

2.3.8 Analysis of <telecom service classify catalog>

3. Analysis of Chinese telecom supervision system and policy

3.1 telecom supervision system

3.2 telecom supervision policy

3.2.1 Policy of interconnect

3.2.2 Guarantee on price

3.2.3 Universal service

3.2.4 charge of telecom resource

3.2.5 Annual check

4 Forecasting of the telecom policy

4.1 trend of the open of telecom market

4.1.1 Strategy of open of telecom market of China government

4.1.2 Policy to change in the near future

4.2 Forecasting of the hotspots in telecom industry

4.2.1 the delivery of 3G license in China

4.2.2 policy of VOIP

4.2.3 IPTV & triple play

The second: process for foreign capital

5. process of entrance into Chinese telecom industry of foreign capital

5.1 process of examine and approve of set up of telecom enterprise for foreign capital

5.2 classify of application of telecom service

5.2.1 Fundamental service and value-added service multi-province

5.2.2 Value-added service inner province

5.2.3 special rules of investment of foreign capital

5.3 the government department of the procedure

5.4 qualification of set up of telecom enterprise for foreign capital

5.5 prepare of the document of application

5.6 application agent and the information

6. Rules of set up of telecom enterprise for investors of Hongkong and macao

6.1 main basis

6.2 rules about joint venter’s supply of value-added service

6.3 procedure of examine and approve

6.4 qualification of material business of Hongkong investors

6.5 procedure of acquire the treatment of the rules

6.6 other aspect

7. rules of M&A in China telecom market for foreign capital

7.1 rules of enter China by means of M&A

7.1.1 Definition of enter China by means of M&A

7.1.2 basis of M&A

7.1.3 laws of M&A

7.1.4 proportion of investment

7.2 procedure of acquire the treatment of M & A

7.3 agreement & trade price of purchase of assets

7.3.1 Agreement of purchase of assets

7.3.2 trade price of purchase of assets

7.4 time limit of payment for M & A

7.5 enroll capital of agreement of purchase and the upper limit of investment

7.5.1 enroll capital of agreement of purchase

7.5.2 The upper limit of investment

7.6 document of delivery to the department of examine and approve

7.7 agreement of capital added inner China

7.8 prepare of capital and document of foreign capital

7.8.1 amount of capital of M & A

7.8.2 Document to prepare for M & A

THE THIRD Telecom service market

8. General trend of China telecom market

8.1 General status of China telecom market

8.1.1 history of telecom industry

8.1.2 Development of scriber size of telecommunication

8.1.3 Development of industry revenue

8.1.4 Development of investment

8.1.5 Characteristic of Chinese telecom consumers

8.1.6 Characteristic of Chinese telecom commercial consumer

8.2 Segmental telecom service market

8.2.1 Fixed telephony service

8.2.2 Mobile phone service

8.2.3 PHS service

8.2.4 Broadband service

8.2.5 Mobile value-added service

8.3 Telecom industry structure

8.3.1 General structure of telecom industry

8.3.2 Industry structure of fixed telephony service

8.3.3 Industry structure Mobile phone service

8.2.3 Industry structure PHS service

8.2.4 Industry structure Broadband service

8.2.5 Industry structure Mobile value-added service

8.4 contrast of telecom service between China and other countries

8.4.1 Contrast of subscriber number

8.4.2 Contrast of service revenue

9. Investment hotspots of China telecom industry

9.1 General description of telecom investment

9.2 3G service

9.2.1 forecasting of 3G service

9.2.2 3G strategy of Chinese telecom service providers

9.3 Investment of mobile value-added service

9.3.1 MMS

9.3.2 WAP

9.3.3 CRBT

9.3.4 JAVA & BREW

9.4 Investment hotspots of broadband

9.4.1 IPTV

9.4.2 IM

9.4.3 Online Game

9.5 other telecom services

9.5.1 VOIP

9.5.2 WLAN

10 Forecasting of telecom trend

10.1 Forecasting of investment environment

10.2 Forecasting of technology development

10.3 Possibility of recombine of telecom service providers

10.4 Life circle of telecom service

The fourth SUGGESTION OF ENTRANCE OF FOREIGN CAPITAL

11. Experience and trend of entrance of foreign capital

11.1 course of entrance of foreign capital\

11.1.1 General status of China use foreign capital

11.1.2 Symbol of entrance of foreign capital

11.2 The way that foreign capital entered

11.2.1 Telecom investment method

11.2.2 proposal of license

11.3 form that foreign capital exist in China telecom industry

11.3.1 Joint venture

11.3.2 Overseas office

11.3.3 Strategic cooperation

11.3.4 Strategic investment

11.4 representative case of entrance of foreign capital

11.4.1 case of VC

11.4.2 Case of Joint venture

11.5 brief summary

11.6 Forecasting of the future of foreign capital

11.6.1 Change of method of Entrance of foreign capital

11.6.2 Forecasting of the future of foreign

12 Suggestion of entrance of foreign capital

12.1 strategy analysis of entrance of foreign capital

12.1.1 attraction of China telecom market

12.1.2 analysis of entrance obstacle

12.1.3 SWOT analysis of foreign telecom service provider

12.2 CSF of entrance of foreign capital

12.3 Suggestion of invest method

12.3.1 Indirect investment

12.3.2 VC

12.3.3 Joint venture

12.3.4 M&A

12.3.5 Absolute operation

12.4 Suggestion of entered province

12.5 Suggestion of entered business domain

12.5.1 Fundamental telecom service

12.5.2 Value-added service

12.5.3 Entrance time

12.5.4 MVNO and its possibility

Table index

Table2-1 agreement of telecom service in china of WTO

Table3-1 purview of guarantee of price

Table8-1 The structure of telecom service revenue of 2003-2004

Table8-2 compare of China telecom service revenue and GDP

Table8-3 the rate of popularization of China telecom service

Table8-4 structure of telecom industry after recombine

Table8-5 mobile subscriber number and market share in 1998-2003

Table8-6 new subscriber number in 2004

Table8-7 some index of economic of important country in the world

Table8-8 compare of phone and mobile number of China and other countries

Table8-9 telecom service revenue of China and other countries

Table9-1 process of 3G in China

Table9-2 Chinese MMS subscriber number in 2003-2005

Table9-3 Chinese WAP subscriber number in 2003-2005

Table9-4 Chinese CRBT subscriber number in 2003-2006

Table9-5 Chinese WLAN subscriber number in 2002-2006

Table11-1 increase of foreign loan in China in 1980-2000

Table11-2 important events of entrance of foreign capital

Table11-3 process of VC of IDG

Table12-1 SWOT analysis of foreign telecom service providers in China

Table12-2 rules of proportion of share control by foreign capital in China telecom market

Graph index

Graph 3-1 guarantee system of China telecom market

Graph 3-2 law system of telecom price

Graph 3-3 structure of telecom price guarantee

Graph 5-1 process of examine and approve of investment on telecom enterprise for foreign capital

Graph 6-1 process of examine and approve of investment on telecom joint venture for capital of Hongkong and Macao

Graph 7-1 process of examine and approve of M & A in telecom industry

Graph 8-1 Increase of number of fixed phone, mobile phone and Internet in 1998-2006

Graph 8-2 increase of telecom service revenue in 2002-2004

Graph 8-3 structure of telecom service revenue in 2003-2004

Graph 8-4 ratio of telecom service quantity, revenue and GDP

Graph 8-5 increase of CAPEX of telecom industry in 1998-2008

Graph 8-6 CAPEX area structure in 2004

Graph 8-7 increase of subscriber number of fixed telephone(2002-2004)

Graph 8-8 increase of subscriber number of mobile telephone(2002-2004)

Graph 8-9 increase of subscriber number of PHS(2002-2004)

Graph 8-10 Subscriber number compare between PHS and fixed telephone

Graph 8-11 Increase of broadband subscriber number(2002-2004)

Graph 8-12 market structure of fundamental telecom service in China

Graph 8-13 market share of fixed telephone

Graph 8-14 Subscriber number compare of fixed telephone and mobile between China and other countries

Graph 8-14 Subscriber number compare of telecom service revenue between China and other countries

Graph 9-3 Increase of subscriber number of CRBT in China(2003-2006)

Graph 9-4 Increase of online subscriber number of IM in China(2002-2006)

Graph 9-5 Increase of revenue of online game in China(2001-2004)

Graph 10-1 life cycle of several telecom service in China in 2005-3-10

Graph 12-1 Entrance obstacle of China telecom service industry for foreign capital

Executive Summary

China has been the biggest potential market in the world. China has entered WTO for 4 years. Because of the high speed of economics and the enormous population, China’s index of telecom service is on the top of the world. But for the strict obstacle of policy and complexity of commercial environment, foreign capital has not been very strong in China telecom industry.

In 2005, it has been the best chance to enter China telecom service market. China telecom market has been more space for foreign capital because of the WTO agreement. The license of 3G will be delivered and the mobile value-added service, internet content service, IPTV service and VOIP service will grow rapidly. And a lot of foreign telecom service providers and investors are eager to enter in China.

The report helps the foreign telecom service providers, equipment vendors, Investors learn China telecom market, confirm the direction of investment, be familiar with the procedure of entrance. CNIIC search and analyze information in a lot of ways, finished the report through plenty of interview with people related.

The research will talk about several questions such as:

Telecom management system, open policy and open step of China;

Procedure of examine and approve of entrance for foreign capital;

Environment about China telecom service market;

Market structure of China telecom service market;

Invest hotspots of China telecom market;

The history of entrance of foreign capital;

Chance and risk for the entrance of foreign capital;

The obstacle the method to overcome for foreign capital;

Suggestion of telecom operation for foreign capital.

China has been the biggest potential market in the world. China has entered WTO for 4 years. Because of the high speed of economics and the enormous population, China’s index of telecom service is on the top of the world. But for the strict obstacle of policy and complexity of commercial environment, foreign capital has not been very strong in China telecom industry.

In 2005, it has been the best chance to enter China telecom service market. China telecom market has been more space for foreign capital because of the WTO agreement. The license of 3G will be delivered and the mobile value-added service, internet content service, IPTV service and VOIP service will grow rapidly. And a lot of foreign telecom service providers and investors are eager to enter in China.

The report helps the foreign telecom service providers, equipment vendors, Investors learn China telecom market, confirm the direction of investment, be familiar with the procedure of entrance. CNIIC search and analyze information in a lot of ways, finished the report through plenty of interview with people related.

The research will talk about several questions such as:

Telecom management system, open policy and open step of China;

Procedure of examine and approve of entrance for foreign capital;

Environment about China telecom service market;

Market structure of China telecom service market;

Invest hotspots of China telecom market;

The history of entrance of foreign capital;

Chance and risk for the entrance of foreign capital;

The obstacle the method to overcome for foreign capital;

Suggestion of telecom operation for foreign capital.

◆ 2005 Annual Report on China's Mobile Phone Battery [ 2005-11-22 ]

报告购买流程

1.选择报告

按行业浏览

按名称查询

2.定购报告

13716899065

传真:010-85863454

服务邮箱:

联系人:段小姐

3.付款方式

*银行电汇

开户名:北京蓝宏智业网络信息技术有限公司

帐号:

0200003809067055806

开户行:中国工商银行八里庄支行

*邮局汇款

地址:北京市朝阳区八里庄西里99号住邦2000商务中心2号楼11层

邮 编:100025

*上门收取

(北京四环以内)

4.发货时间

3-5天(定制报告除外)

5.送货方式

电子版报告:

Email或光盘发送

纸介版报告:

北京—快递、上门

外地—邮政EMS

国外—敦豪快递

购物车

购物车